Arkansas Property Tax

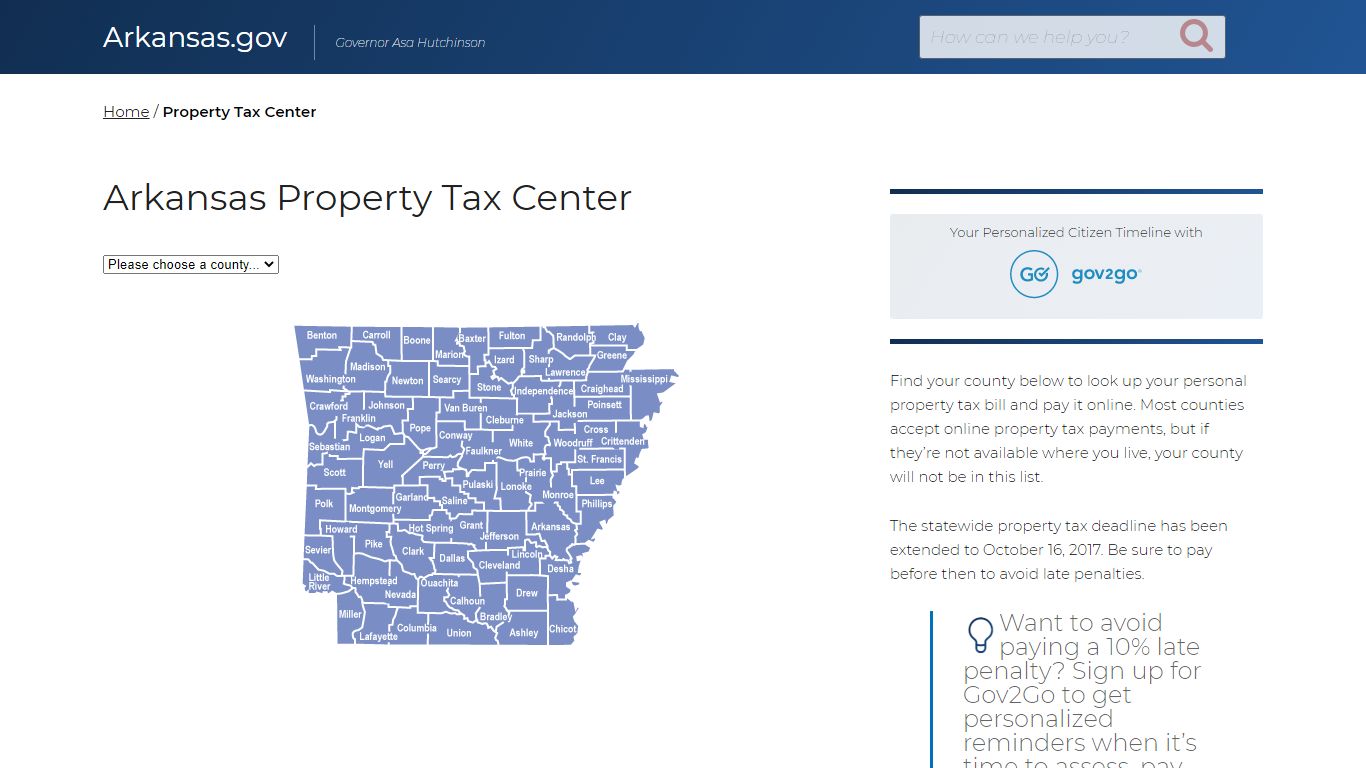

Property Tax Center - Arkansas.gov

Locate your county on the map or select from the drop-down menu to find ways to pay your personal property tax. Online payments are available for most counties. Pay-by-Phone IVR # 1-866-257-2055

https://portal.arkansas.gov/property-tax-center/

Arkansas Property Taxes By County - 2022 - Tax-Rates.org

The median property tax in Arkansas is $532.00 per year for a home worth the median value of $102,900.00. Counties in Arkansas collect an average of 0.52% of a property's assesed fair market value as property tax per year. Arkansas has one of the lowest median property tax rates in the United States, with only four states collecting a lower ...

https://www.tax-rates.org/arkansas/property-tax

Assess & Pay Property Taxes - Arkansas.gov

Assess & Pay Property Taxes. Locate contact information for your county assessor and tax collector.

https://portal.arkansas.gov/popular_services/assess-pay-property-taxes/

Arkansas Property Tax Center | Arkansas.gov

Find your county below to look up your personal property tax bill and pay it online. Most counties accept online property tax payments, but if they’re not available where you live, your county will not be in this list. The statewide property tax deadline has been extended to October 16, 2017. Be sure to pay before then to avoid late penalties ...

http://www.beta.arkansas.gov/pages/property-tax-center/

Property Taxes in Arkansas | Tax Foundation

Of all taxes collected in Arkansas (state and local combined), 18.1 percent comes from property taxes. That’s the fifth lowest in the nation, where the average is 31 percent, and lower than all our neighbors (roughly equal to Oklahoma’s). Our two neighbors without income taxes, Tennessee and Texas, rely much more on property taxes ...

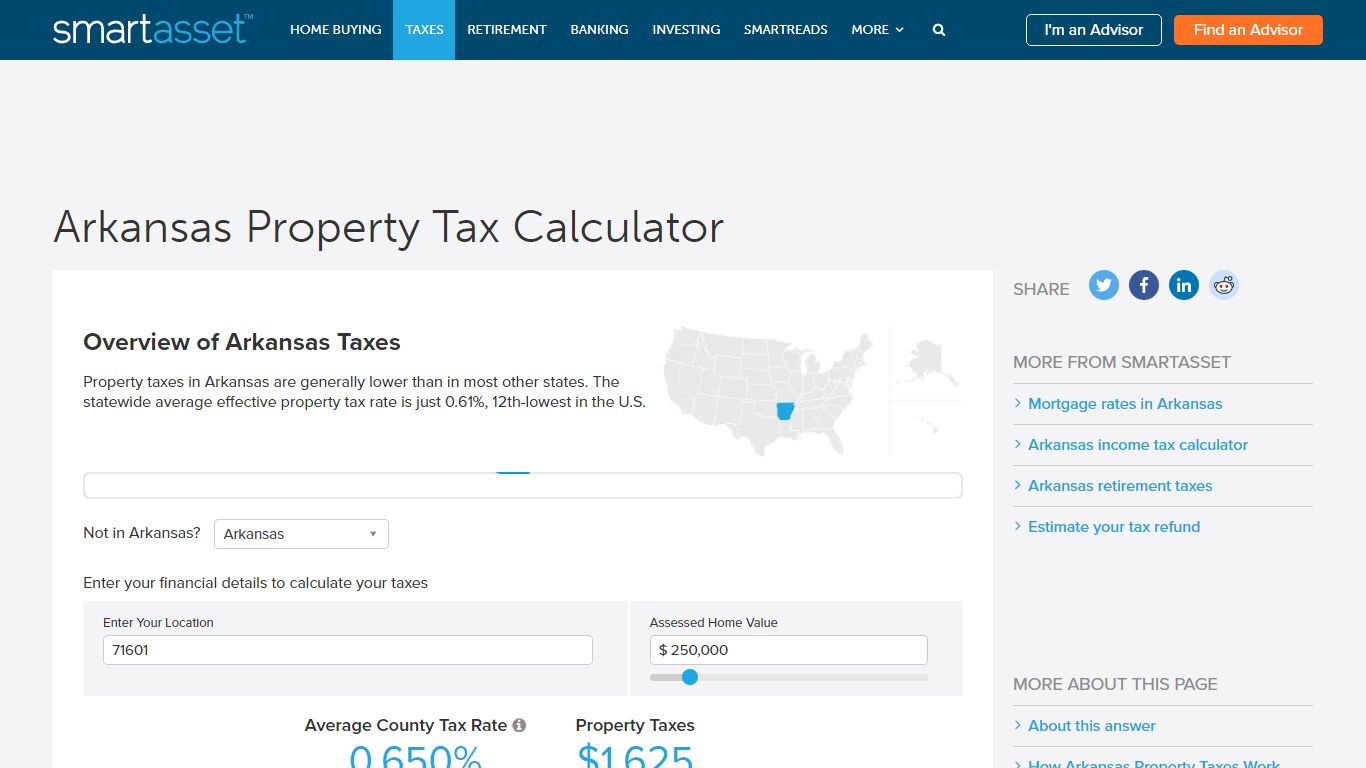

https://taxfoundation.org/property-taxes-arkansas/Arkansas Property Tax Calculator - SmartAsset

Property taxes in Arkansas are lower than in most of the rest of the country. The majority of the state's counties have median annual property tax payments below $800. The statewide average effective property tax rate is 0.61%.

https://smartasset.com/taxes/arkansas-property-tax-calculator

Property Tax Rates in Arkansas | AEDC

The State of Arkansas does not have a property tax. However, Arkansas cities and counties do collect property tax, which is the principle local source of revenue for funding public schools. The tax is calculated based on 20% of the market value of real and personal property and the average annual value of merchants' stocks and/or manufacturers ...

https://www.arkansasedc.com/why-arkansas/business-climate/tax-structure/property-tax

How do I pay personal property taxes? - Arkansas.gov

Pay Franchise Taxes; INA Subscriber Account; Search All Services; Citizens. Driver & Motor Vehicle Services; Property Tax Center; Offender Banking; County Government Services; AR Taxpayer Access Point (ATAP) Voter Information; Unclaimed Property; Criminal Background Check; Medical Marijuana *11 Services; Search All Services; Children & Family ...

https://portal.arkansas.gov/faqs/how-do-i-pay-personal-property-taxes/

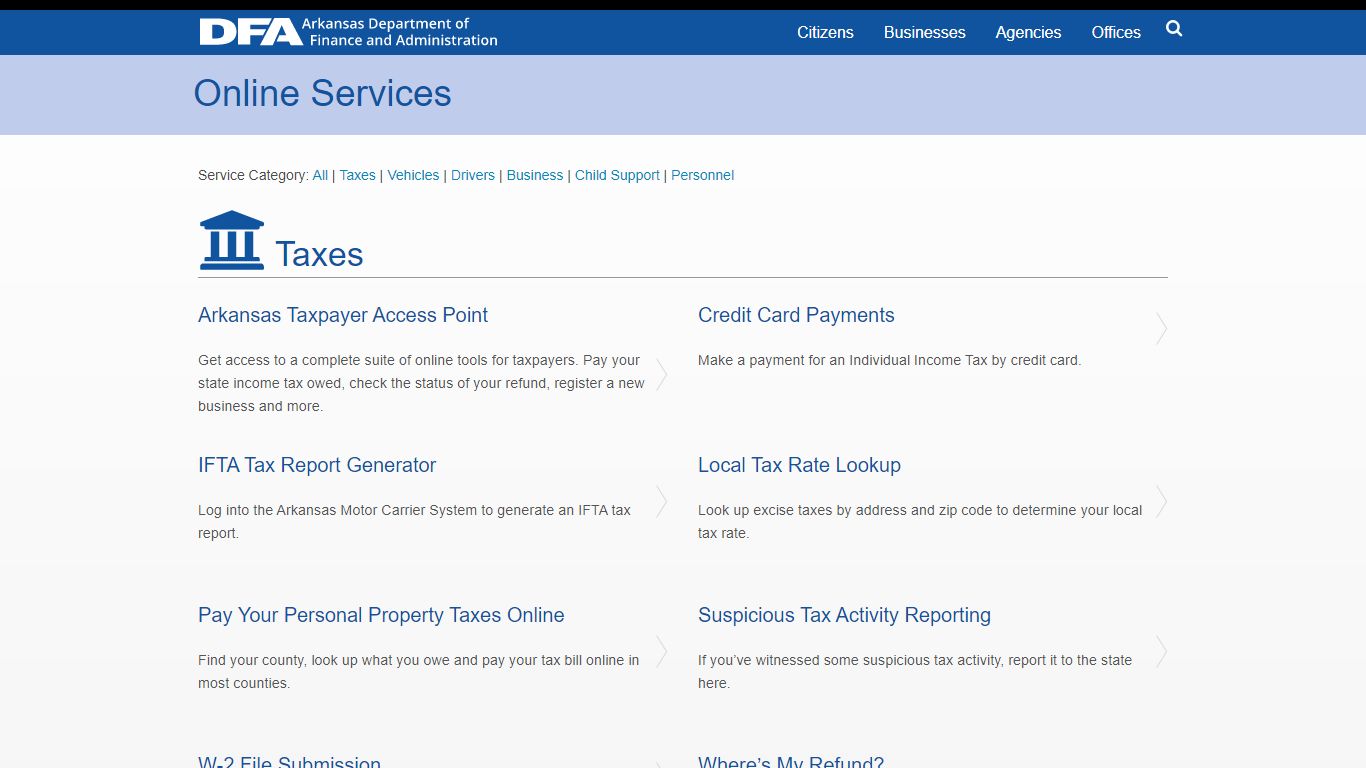

Taxes | Department of Finance and Administration - Arkansas

Arkansas Taxpayer Access Point. Get access to a complete suite of online tools for taxpayers. Pay your state income tax owed, check the status of your refund, register a new business and more. Credit Card Payments. ... Pay Your Personal Property Taxes Online. Find your county, look up what you owe and pay your tax bill online in most counties. ...

https://www.dfa.arkansas.gov/services/category/taxes/

Arkansas County Tax Collector Record Search - ARCountyData.com

Arkansas County Personal Property & Real Estate Tax Records. Home; Arkansas County; Tax Collector Record Search; Search Options. Last Name or Business Name. First Name. Address. Tax Year. PPAN/Parcel Number Higher Than. Taxpayer ID ... Pay Arkansas County Taxes Online .

https://www.arcountydata.com/propsearch.asp?county=ArkansasReal Estate | Department of Finance and Administration - Arkansas

Real Property Transfer Tax applies to transferring ownership of mineral rights. ... please contact the Miscellaneous Tax Section to have a corrected stamp created. Miscellaneous Tax Section 1816 W 7th St, Room 2340 PO Box 896 Little Rock, AR 72203. Telephone #: 501-682-7187 Fax #: 501-682-1103 Applicable Statutes: AR Code Ann. §26-60-101 et ...

https://www.dfa.arkansas.gov/excise-tax/miscellaneous-tax/real-estate